Commercial Invoices are a crucial part to international shipping, and there is no escape. There is often confusion about which documents you need to include to get your package to its final destination as smoothly as possible. In this article we explain what a commercial invoice is, why you need this document and how to fill it out.

In this article, we will answer the following questions:

Let’s dive right in and explore the fascinating world of Commercial Invoices! It’s crucial to understand this concept from the very beginning because it’s the key to smooth, hassle-free international shipping.

A Commercial Invoice is a special export document that helps your package get through customs. It is not just a routine piece of paperwork; it serves as a crucial documentation tool in international trade transactions. Essentially, it acts as a formal request for payment from the buyer to the seller for goods or services provided. It outlines key details of the transaction, including a description of the goods, their value, quantity, and terms of sale. Moreover, it serves as a legal document, providing evidence of the transaction and facilitating customs clearance processes.

A commercial invoice is required in international trade transactions when goods are sold across international borders. Packages within the EU do not require this special invoice. You can find a list of EU countries on the website of the Dutch Tax and Customs Administration, for example. If in doubt, you can also consult the list of exceptions because some countries or territories are part of the EU but are not part of the EU customs territory.

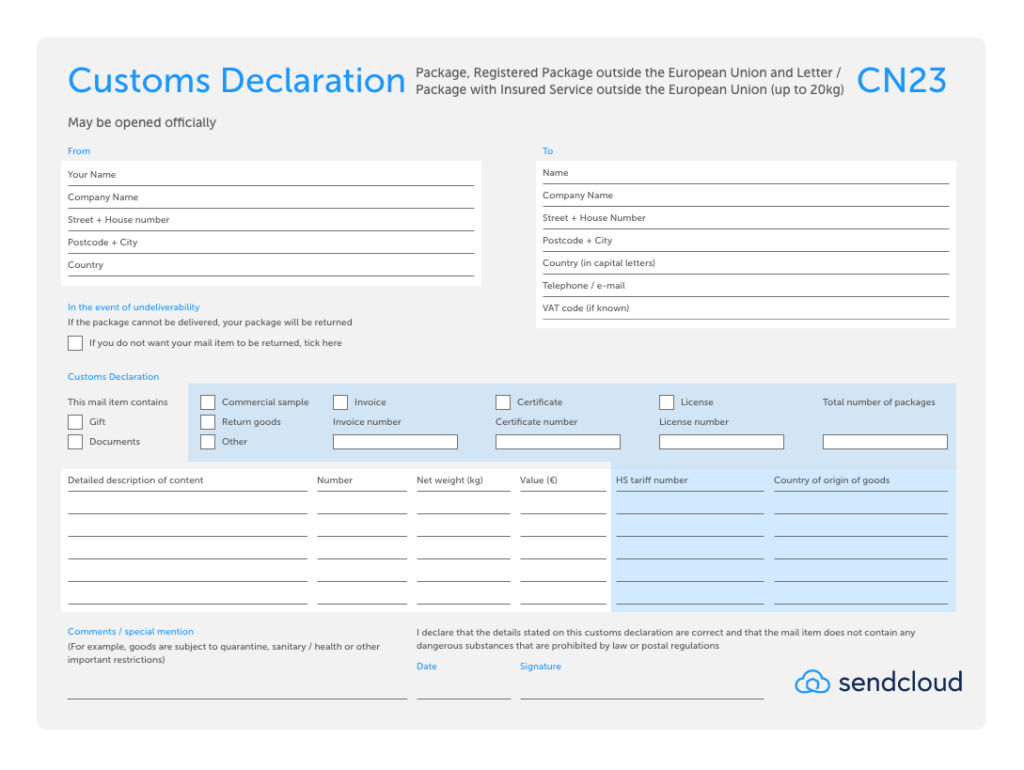

In addition to the commercial invoice, some international shipments outside the EU also require a customs declaration (CN22 or CN23), a CP71 dispatch note, and possibly a Certificate of Origin (CO). This article will mainly discuss commercial invoices for international shipping.

Not having a commercial invoice for international shipments can cause problems. Without this document, customs clearance may be delayed or even denied, leading to costly storage fees, returned shipments, or legal penalties. Also, not having a commercial invoice makes it harder to resolve disputes over payment, product quality, and compliance with trade regulations. A commercial invoice helps to avoid risks and make international trade more efficient.

Start automating your shipping process today

More than 2000 five star reviews

A properly completed and correct commercial invoice for export helps customs authorities quickly decide which taxes and import duties apply to your package. And this prevents delays.

In addition, customs officials can see whether your package meets all the requirements and they can pass on information (e.g. the recipient’s tax liability) to the country of destination. If you fill in this invoice correctly, there is a greater chance that your package will arrive on time.

When sending an international package to a country outside the EU, you often need several documents. Sometimes people are confused about the difference between the Commercial Invoice and other customs documentation required for international shipments. This is not surprising: while both the Commercial Invoice and customs declaration forms, such as CN22 and CN23, provide customs authorities with information about the goods entering and leaving a country, they serve different purposes and should not be mixed up. So what exactly is the difference? Let’s find out:

A CN22 or CN23 form is a mandatory customs form that must be added to shipments outside the EU. The form is mainly used for shipments that are transported by a postal company. The value or weight of the shipment determines whether you use form CN22 or CN23. The form contains information about the goods being transported and this information is used to determine whether tax must be paid. A CN23 form is always accompanied by a CP71 dispatch note.

A CN22 or CN23 document requires you to fill in a bit more information than the commercial invoice, but the idea behind it is the same. Both documents provide information about the contents of the package so that customs authorities can decide whether the parcel can enter the country, and who is responsible for which taxes and import duties.

As explained above, the commercial invoice is also an export document that you add to all commercial shipments outside the EU. It is a binding customs document that mainly contains information about the contents of the package and the agreements made (Incoterms ), such as who pays the customs costs. Based on the commercial invoice, the customs authorities determine whether import duties have to be paid on the goods.

The main difference is that a commercial invoice is always required for all e-commerce shipments, and only parcels sent via postal services need the additional CN22 or CN23 document.

However, to avoid delays, we recommend that you always add both documents.

While a commercial invoice provides detailed information about the contents of a package, including the value, quantity, and terms of sale, a packing list serves a different purpose. The packing list primarily documents the physical contents of the shipment, detailing each item’s dimensions, weight, and packaging type. While both documents aid in customs clearance, the commercial invoice focuses on the financial aspects of the transaction, while the packing list provides logistical information.

A customs invoice, similar to a commercial invoice, is a document required for international shipments to provide customs authorities with essential information about the goods being imported or exported. However, a customs invoice may include additional details specific to customs regulations, such as the country of origin, harmonized tariff codes, and any applicable trade agreements or preferences. While there may be overlap between the two documents, the customs invoice is tailored to meet the specific requirements of customs clearance procedures.

While both documents provide details about the goods being shipped, a Commercial Invoice focuses on the financial aspects of the transaction, such as the value of the goods, payment terms, and the parties involved in the sale. On the other hand, a shipping invoice primarily documents the shipping and handling charges associated with transporting the goods, including freight costs, insurance fees, and any additional surcharges. While complementary, each document serves a distinct purpose in the international trade process, with the Commercial Invoice emphasizing the commercial aspects and the shipping invoice detailing logistical and transportation-related expenses.

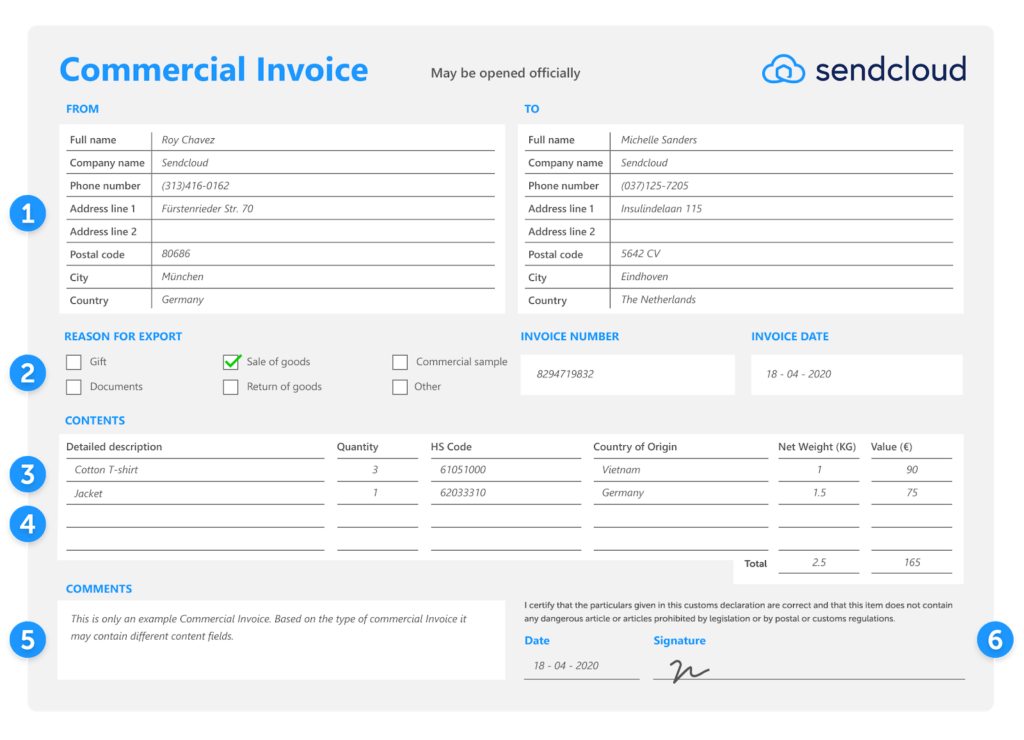

What has to be on a commercial invoice? Although there is no standard format, the document must contain several fixed elements, such as details about the parties involved in the shipment and information about the goods. Below you will find the most difficult parts of the commercial invoice, and below that, you will find an explanatory glossary.

Please note: A commercial invoice must always be in English.

commercial invoice example " width="1024" height="740" />

commercial invoice example " width="1024" height="740" />

It may seem obvious, but describing the contents of the package is an important part of the commercial invoice. This gives customs authorities a clear overview of what you are shipping. The description must explain exactly what you are sending, what the article is made of and, if applicable, what its purpose is. Do this for each item separately. Customs packages are often scanned, and you may be fined if the description does not match the contents of the package. Therefore, it is very important to do this accurately.

Also state the number of items, the total weight, and the total value in euros of the contents of your package. It is important that you determine the value accurately. Even a sample, gift or return shipment has a value.

Every item in your package must have an HS code or commodity code. The Harmonized System (HS codes) classifies goods so that customs authorities know which taxes, excise duties, and controls apply. It is important that you enter the correct code as it determines the number of import duties or other taxes you must pay. Looking up the code can be difficult, but there are a number of ways to find your product’s code.

The manufacturer of your product often knows its HS code. If you don’t have this information, you can look up the code yourself. You can use Sendcloud’s quick and easy tool to search for the right HS code. Or, go to trade tariffs on the customs administration website and click on the ‘Nomenclature’ tab. There you will find all the commodity codes. Do you need more help? Then read the manual on looking up commodity codes. Finally, you can contact the tax and customs agency in your country for more information.

In the ‘country of origin’ field, you state where your goods were produced. In some cases, you will need a CO document as an additional document. Some countries outside the EU request this document for trade policy measures.

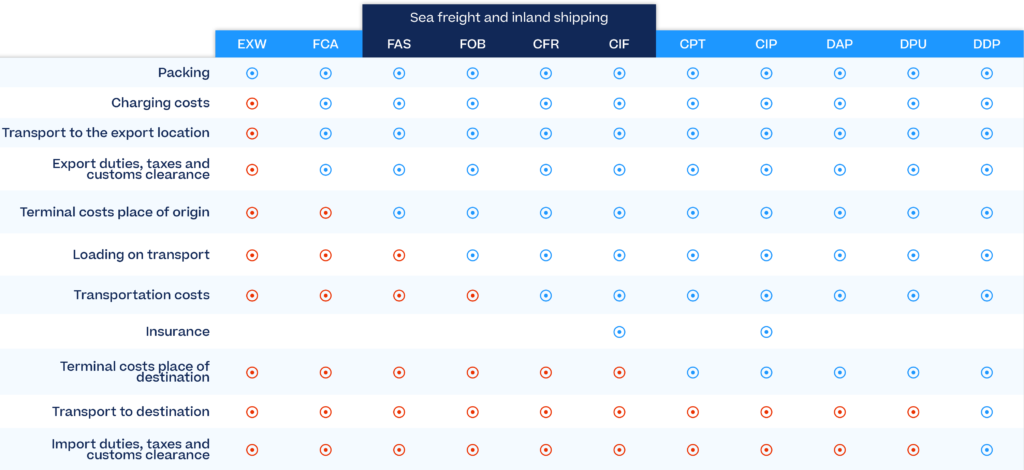

The International Commercial Terms or ‘Incoterms’ are standardized international agreements on the transport of goods. The Incoterms clarify:

Please note that the carrier you have chosen also supports these Incoterms.

The Incoterms are updated every ten years and so have just been updated for 2020. The 2010 Incoterms remain in force, but more and more companies will be switching to the 2020 Incoterms. Read our update about the 2020 Incoterms here. The most common Incoterms are EWX (Ex Works), FOB (Free on Board), CFR (Cost & Freight), DAP (Delivered At Place) and DDP (Delivered Duty Paid). If you don’t know which Incoterm is best for you, we recommend you choose DAP. This means that you as the seller pay the shipping costs, arrange the insurance and prepare the export documents. The recipient pays any import and customs duties.