Hamden has been using property taxes to curb its massive debt and pension liabilities — the highest in Connecticut. Maintaining high property taxes to pay off these debts however, may also be keeping renters from buying in Hamden and curbing the town’s growth.

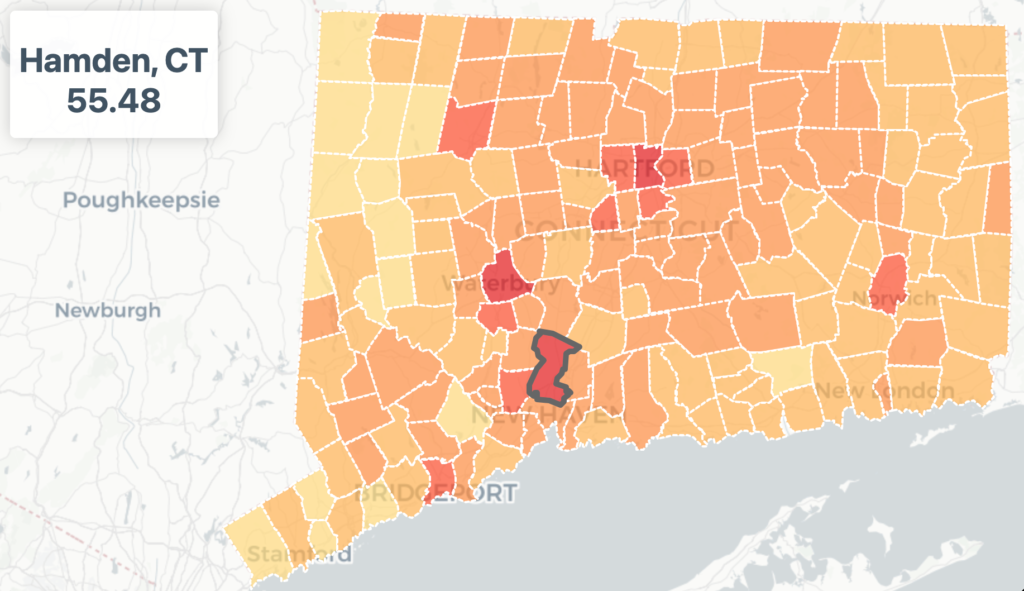

Many U.S. towns and cities rely heavily on property taxes to fund their budgets. Hamden’s property taxes are the fourth highest in Connecticut, generating a $55,480 annual tax bill on a home whose value is assessed at $1 million.

Hamden Mayor Lauren Garrett and residents have tried to balance keeping property taxes manageable while taking responsibility for inherited debt.

“For the last couple of decades, Hamden hasn’t paid what it costs to run the town,” Garrett said, comparing the problem to using a credit card to fund a bunch of purchases, “but then you only make the minimum payment. The amount that you owe on that credit card just goes up and up.”

The town’s failure to sufficiently pay into its pension system and address its debt over the years is now catching up with it.

“Our debt has increased over time, and so now it costs more for us to make payments toward the pension,” Garrett said. “Because of not paying it 20 years ago, it costs more for our debt now, because of years of kicking the can down the road.”

According to Investopedia, there are three steps to calculate a mill rate, or the amount of tax payable on each $1 of a home’s assessed value.

First, the local government determines how much money it needs to raise through property taxes to cover its budget, or the total revenue needed. Next, it determines the total assessed value of all taxable properties within the municipality. A town assessor normally determines the value of each property, which is not the same as its market value. Finally, the total revenue needed is divided by the total assessed value and then multiplied by 1,000 to get the mill rate.

The chart below shows Hamden’s mill rate, of 55.48 in red, among the highest in the state, compared to other towns and cities, with the lowest rates in beige.

A town that needs more revenue from property taxes can raise the mill rate or the assessed value of existing homes. Some towns can find more property to tax, which is difficult in Hamden due to the large property holdings of Quinnipiac University and other nonprofits.

Garrett didn’t blame Quinnpiac for this problem, highlighting instead years of underpayment by former mayors.

“Hamden is where it is because of years of adding on to it without paying it down. So the bills are due, and we need to make those payments,” Garrett said.

Residents — and potential residents — think a lot about property taxes when deciding to buy or stay in a town.

When Maya Stevens was looking at moving out of her parents’ house in Wallingford, she and her boyfriend considered property taxes in nearby towns. “The tax we were going to pay in Hamden versus some of the other towns nearby, was like 15% or 20% higher, or even over 50% higher than in Wallingford,” she said. Stevens ended up moving to Georgia to live closer to her boyfriend’s family.

Looking forward, Mayor Garrett said that property taxes “will stay pretty flat,” as the town reassesses the value of each property.

With the real estate market on an upswing, property values have been rising over the past few years. This could have a beneficial effect on the mill rate.

“What we’ll see is a slight decrease in the mill rate because of the revaluation,” Garrett predicted. “While that’ll be a slight decrease in the mill rate, it won’t necessarily mean that taxes come down.”

This means Hamden renters looking to buy often look elsewhere.

Jessica Reynolds felt “financially ready to make the leap” into homeownership after five years of renting in Hamden, but said “the property taxes here gave me pause. It feels like an added burden, especially when thinking long-term,” said the 48-year-old. “The desire to own a place in Hamden is strong, but I have to think about the financial sustainability for my family.”

In May of 2023, Garrett’s budget plan included a 0.9-mill increase, smaller than the anticipated 1.3-mill increase, bringing the mill rate up to 56.38.

While Hamden has a challenging fiscal journey ahead, there seems to be a clear roadmap. Garrett’s approach is to face the town’s debts head-on and ensure future generations aren’t burdened by past decisions. With a potential stabilization in the mill rate and a revaluation on the horizon, Hamden’s residents can look forward with cautious optimism.

When searching for a place to call home or own a business, property taxes can play a key role. However, Garrett says the high mill rate hasn’t deterred people away from one of Connecticut’s largest towns.

“Home sales have just continued to be very successful,” she observed. “The housing market is still pretty hot right now.”

However, residential real estate is just one side of the story. The town’s appeal to business owners is crucial for its overall economic health. On this front, Mayor Garrett shared that predictability is the key.

“What I’ve heard from a lot of business owners is that they just want to know what the outlook is. They want to be able to predict what they’re going to have to pay in taxes over the next several years. It’s helpful for them to see a 5-year plan, which I’ve submitted with the last two budgets,” Garret said.

By providing a clear trajectory for the town’s mill rate and taxes, the mayor believes this provides the stability and confidence businesses require.

On of the reason’s why Hamden’s property taxes are so high is becase of Quinnipiac University. Quinnipiac owns a significant amount of property within the town, and, as a nonprofit organization, the university is exempt from paying property taxes.

The advantages of having an institution like Quinnipiac in Hamden are manifold. It bolsters the town’s reputation, attracts a diverse population of students and faculty, and generates economic activity through employment, local spending by students and visitors, and various events and programs. Moreover, universities often engage in community outreach and partnerships that can be beneficial to the town in various ways.

However, the tax-exempt status of such a large property owner does present challenges for Hamden’s finances. The town forgoes a significant potential source of revenue due to this exemption. As a result, the fiscal burden is distributed among the other taxable entities, including homeowners and businesses. In situations where towns have budgetary constraints or high liabilities, as with Hamden, the absence of taxes from large landowners like Quinnipiac can exacerbate financial pressures.

The dynamic between towns and their nonprofit institutions is complex. While the tax exemptions are designed to support the charitable, educational, and community-focused missions of organizations like Quinnipiac, towns and governments are left with finding a balance to ensure they can fund their essential services and meet their financial obligations. Some towns engage in Payment in Lieu of Taxes (PILOT) programs with large nonprofits, where these entities voluntarily offer payments to help offset the loss of potential tax revenue. While this has yet to happen in Hamden, it could be a viable option for a town grappling with sky-high tax rates.