Flood insurance compliance risks for financial institutions are back on the radar for examiners, as evidenced by recent examination results. In particular, examiners have set their sights on cross-collateral clauses in mortgages and deeds of trust as another area that can cause loans to be underinsured.

Ensuring adequate flood insurance coverage can already be a challenging proposition for financial institutions, but it’s often worsened by the use of cross-collateral language in mortgages and deeds of trust.

Here is what your financial institution needs to know to help make navigating cross-collateralization and compliance easier:

Cross-collateralization occurs when an asset serving as collateral for one loan is used to secure a second loan.

Throughout the industry, financial institutions have used cross-collateralization for various reasons. The associated language in a mortgage is not a new practice. And the use of this language in an existing mortgage means that multiple loans are secured by the same property.

Ensuring adequate flood insurance coverage can be a challenging proposition for financial institutions, which can be exacerbated by the use of cross-collateral language in mortgages and deeds of trust. The Flood Disaster Protection Act (FDPA) stipulates that a “lending institution may not make, increase, extend, or renew any loan secured by improved real property that is located in an SFHA unless the improved real property is covered by the minimum amount of flood insurance required by statute.”

Under the rules, the amount of flood insurance must be at least equal to the lesser of the outstanding principal balance of the designated loan or the maximum limit of coverage available for the particular type of property.

If a property securing multiple loans is located in a special flood hazard area (SFHA), it can affect when the flood rules are triggered and the calculation for determining the minimum amount of flood insurance required.

Cross-collateral clauses come in various shapes and sizes, but typical cross-collateral language may look something like this:

Cross-collateralization. In addition to the Note, this Mortgage secures all obligations, debts and liabilities, plus interest thereon, of either Grantor or Borrower to Lender, or any one or more of them, as well as all claims by Lender against Borrower and Grantor or any one or more of them, whether now existing or hereafter arising, whether related or unrelated to the purpose of the Note, whether voluntary or otherwise, whether due or not due, direct or indirect, determined or undetermined, absolute or contingent, liquidated or unliquidated whether Borrower or Grantor may be liable individually or jointly with others, whether obligated as guarantor, surety, accommodation party or otherwise, and whether recovery upon such amounts may be or hereafter may become barred by any statute of limitations and whether the obligation to repay such amounts may be hereafter may become otherwise unenforceable.

When such language is included in a preexisting mortgage, and the loan is secured by property in an SFHA, the flood requirements are triggered each time a loan is made to that borrower after granting a deed of trust or mortgage with a cross-collateral clause.

If the insurance was previously written for the amount of the outstanding principal balance of the loan, the lender must reevaluate the flood insurance protecting the structures securing the debt.

If you have a valid cross-collateralization, your loan amount to calculate flood insurance is the combination of all loans that are cross-collateralized, regardless of any existing collateral for each loan.

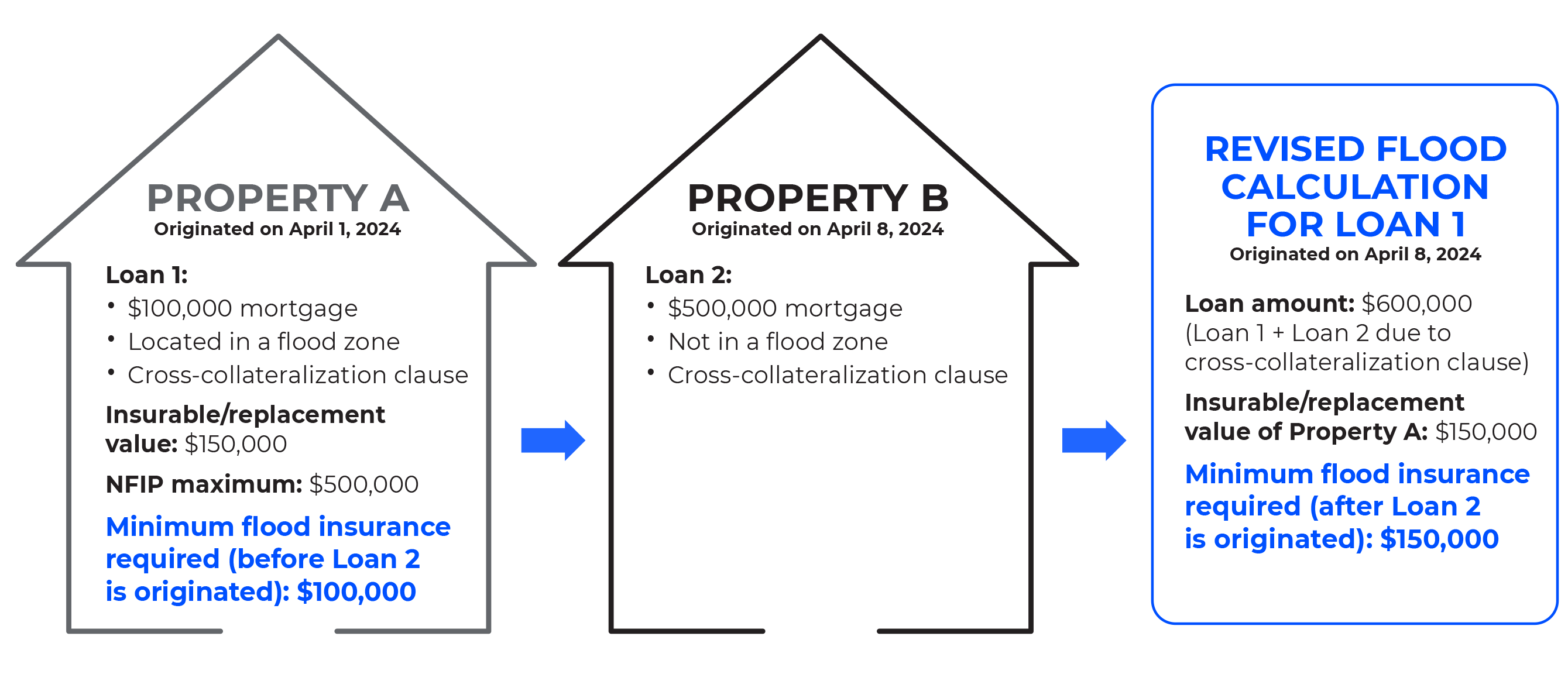

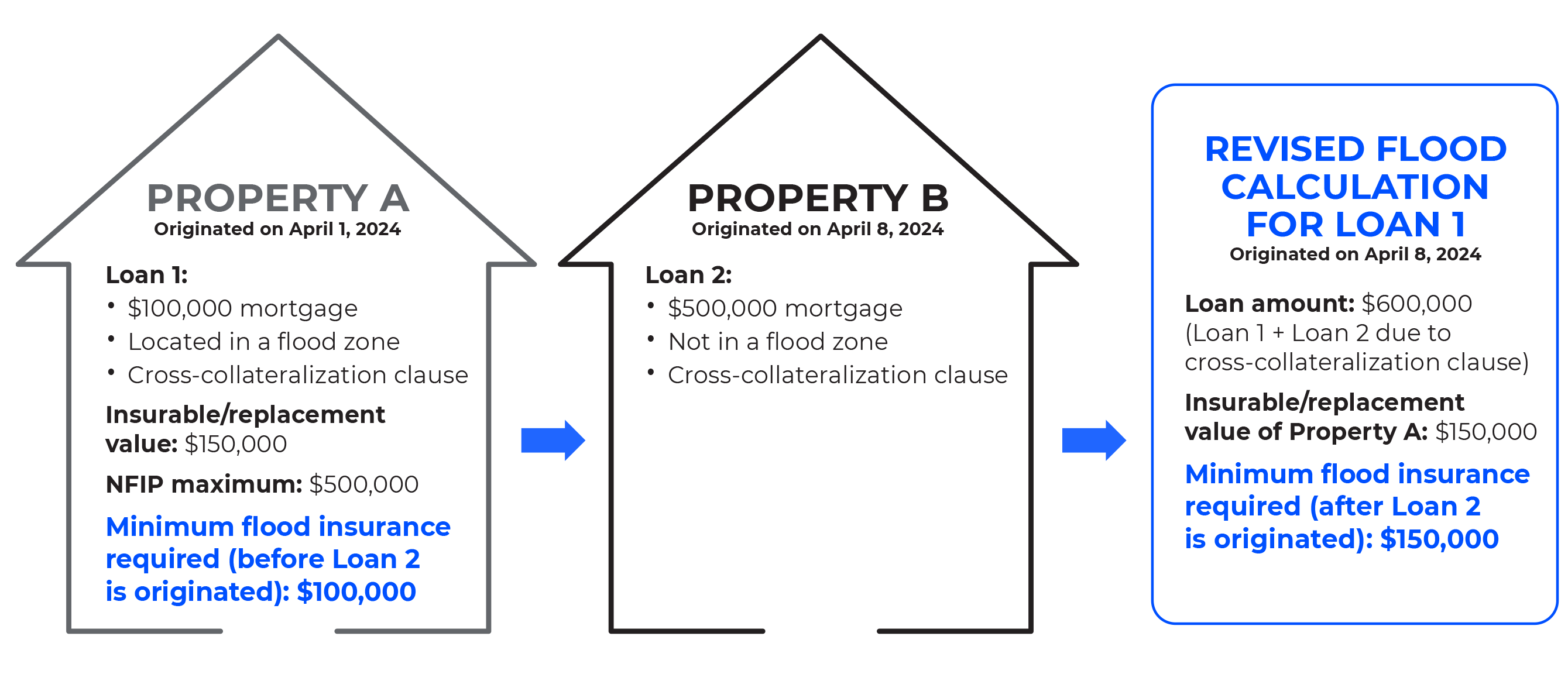

For example, if you originate a loan on April 1, 2024, with a cross-collateralization clause for $100,000 with a security agreement in place for Property A, which is located in an SFHA — and the insurable/replacement value of Property A is $150,000 and the National Flood Insurance Program maximum for the property is $500,000 — the minimum amount of flood insurance would be $100,000.

If Loan 2 was then originated on April 8, 2024, to the same borrower the next week for $500,000, which is secured by Property B, which is not in a special flood hazard area, flood insurance would not be required for this loan.

However, because of the cross-collateralization clause, this loan is also secured by Property A, which is in a flood zone. As such, when Loan 2 is originated, the loan amount of Loan 2 of $500,000 would need to be included in the loan amount when calculating the minimum amount of flood insurance for Loan 1 and Property A. As a result, instead of a minimum amount of $100,000 in flood insurance being required, this will now increase to $150,000 (the replacement cost/insurable value) of the property.

The following actions can help you manage the potential impacts of cross-collateralization:

Have your qualified internal compliance and/or legal experts or your external legal counsel review your current standard note, mortgage or security agreement language to determine if any cross-collateralization language is included.

Keep in mind that although this language is most likely to appear in commercial or business-purpose mortgages or security agreements, it could also be present in consumer-purpose loans as well. If the cross-collateralization language exists in your current mortgages or security agreements, determine the impact on your existing portfolio of loans and come up with a plan for any new loans going forward.

First, for evaluating your existing portfolio, pull a report of all impacted loans that are currently being tracked as loans in a special flood hazard area. If this language only exists in your commercial mortgages or security agreements, then this report should be targeted to commercial loans where the collateral is located in a special flood hazard area.

Check each loan and confirm that the cross-collateral language exists in the mortgage/security agreement.

If cross-collateral language is present on your existing mortgages, you have several risk-based options to help ensure compliance with flood insurance requirements:

Regardless of the next steps you choose to take, there will be risk involved. Three areas to watch for include:

After you have addressed any existing loans, consider how you want to proceed with any new loans going forward. This may involve modifying the language in your mortgage or security agreements to remove or waive cross-collateral clauses when flood insurance is required.

Alternatively, you may wish to move forward with your existing language; however, you will want to make sure there are sound policies, processes and written procedures in place to address the calculation of flood insurance at both origination and renewal in instances where a cross-collateralization clause is in effect.

The mortgage or security agreement is a legal contract with your borrower(s) and as such, any changes or modifications should be discussed with your institution’s legal counsel. You may also want to discuss any possible actions with your primary regulator to help ensure they are on board with your plans.

If you have any questions about the impacts of cross-collateralization on flood insurance requirements, contact Wipfli. We monitor the latest regulatory updates so that we can help your financial institution draft appropriate policies and procedures. Contact us today to learn more about how we can help you gain confidence in your compliance.

Sign up to receive additional financial institution content in your inbox or continue reading: