As a small business owner, you set an ultimate goal to turn a profit on your passion project. Offering a variety of payment options gives you more opportunity to boost your bottom line, while also giving your customers the flexibility to pay with the method that works best for them.

Customer credit is a popular payment option for both B2B and B2C transactions, but incorporating customer credit into your accounts receivable can be intimidating at first.

In this guide, we’ll define customer credit and its pros and cons, discuss credit policy options, identify how to mitigate risk with credit reports, and explain how your business can start offering customer credit if it makes sense to do so. Read on for a full picture of customer credit, or use the links below to skip ahead.

Customer credit is a form of payment that allows small business customers to purchase a product or service before paying for it in full. The process works similarly to the way a credit card does—you procure something and pay it back later. But when a small business offers customer credit, they take on the credit risk, not the credit card company.

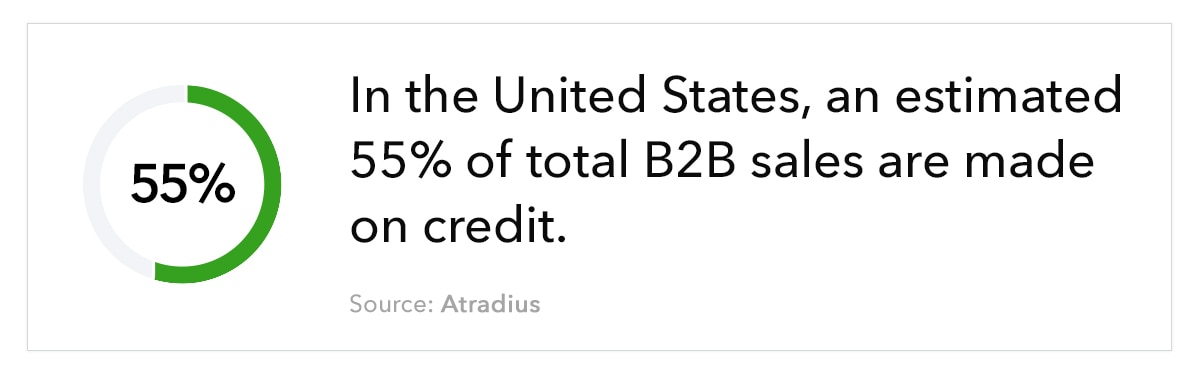

Credit is a very common payment structure for small businesses, especially when conducting business to business (B2B) transactions . In fact, an estimated 55% of total B2B sales in the United States are paid using customer credit.

What exactly does customer credit look like? Let’s go over an example of how customer credit works in a B2B transaction:

Let’s say you supply fresh fish to local restaurants, and you allow your restaurant partners to pay in credit. You invoice them for the total amount due, outlining your payment terms, which may include information on late fees and credit limits. This is a typical example of what customer credit looks like.

Customer credit gives your clients a little extra wiggle room to pay for the products or services ordered. This can be especially helpful when conducting B2B transactions with other small businesses that may not have the cash flow upfront but can pay later on down the road.

Inviting your customers to pay by credit can offer up a variety of potential benefits:

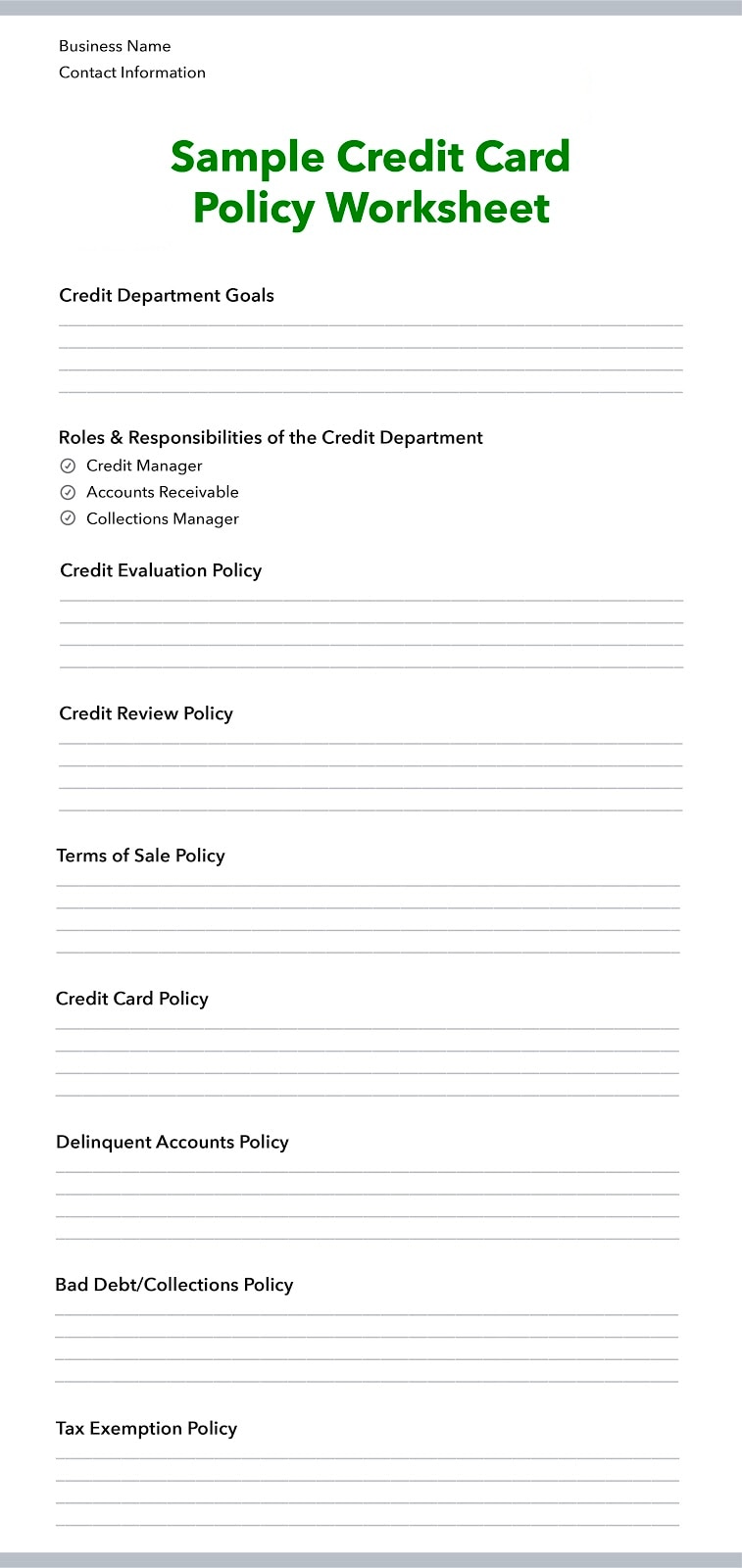

A credit policy is a set of guidelines a business uses to set payment terms for its customers. A credit policy also acts as a document for internal reference.

A credit policy can include guidelines such as:

Credit policies are important for several reasons: they create payment guidelines and offer instructions for your customers to complete payment. But ultimately, credit policies protect your small business financially by establishing payment expectations and, in turn, minimize the number of bad debts you may have to write off at the end of the year.

Now that you’re familiar with the purpose credit policies serve, let’s take a closer look at the components of a credit policy.

Credit limit describes the maximum amount of credit your small business will offer to customers. Just like credit card companies limit how much you can spend as part of their credit risk management, so too can small businesses. Setting a credit limit can help you keep your accounts receivable funded and, ultimately, protect your small business’s cash flow. You may choose to set the credit limit for individual customers according to factors like their credit history.

Credit terms outline the credit agreement you have with your customer. These terms can include the payment due date, penalties for late payments, and guidelines for when credit can be extended.

Collections methods indicate the actions your business can or will take if customer payments are not fulfilled. Typically, businesses will seek initial payment with an invoice, followed by a reminder , and later, legal action and pursuit with the help of a collection agency.

Now that you have a clearer understanding of customer credit and credit policies, it’s time to create your own terms of sale. Use the template below to get started.

If you plan to offer credit to your customers, consider these best practices.

When you allow customers to pay with a credit card, the credit card company assumes most of the risk if the cardholder fails to pay their bill. But when small business owners allow customers to pay on credit via check or invoice, the business takes on the risk of the customer’s bad debt.

To mitigate risk, some small business owners, or their credit department, will evaluate their customer’s creditworthiness before extending credit. You can run a credit history check on customers through one of the three major credit bureaus, TransUnion, Experian, and Equifax.

Setting payment expectations with your customers from the start can help you avoid payment issues later on down the road. Before customers pay with credit, make sure they’re aware of your credit policy and agree with the payment terms. A documented policy ensures all parties involved understand the terms of the agreement.

Collect information from the customers applying for credit, including:

This information can help you make informed decisions about whether you should extend credit, and how much you should offer.

Once you’ve decided to extend credit to a customer, invoices are your way of billing them for the products or services they purchase. An invoice typically includes the amount due, due date, payment methods, and information regarding your credit policy. Sometimes, customers are timely with their payments, while other times they need a reminder.

With QuickBooks , you can easily generate invoices and schedule reminders to get outstanding balances sorted out ASAP.

Offering customer credit can be a headache without a good process. Streamline your credit sales with QuickBooks. QuickBooks accounting software makes it easy to keep track of unpaid invoices, monitor accounts receivable funding, and more.

Recommended for you

How to Calculate Your Accounts Receivable Turnover Ratio

September 25, 2020

What is days sales outstanding? How to calculate and improve DSO

What is working capital: definition, formula, & management tips

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.